Start-up valuation

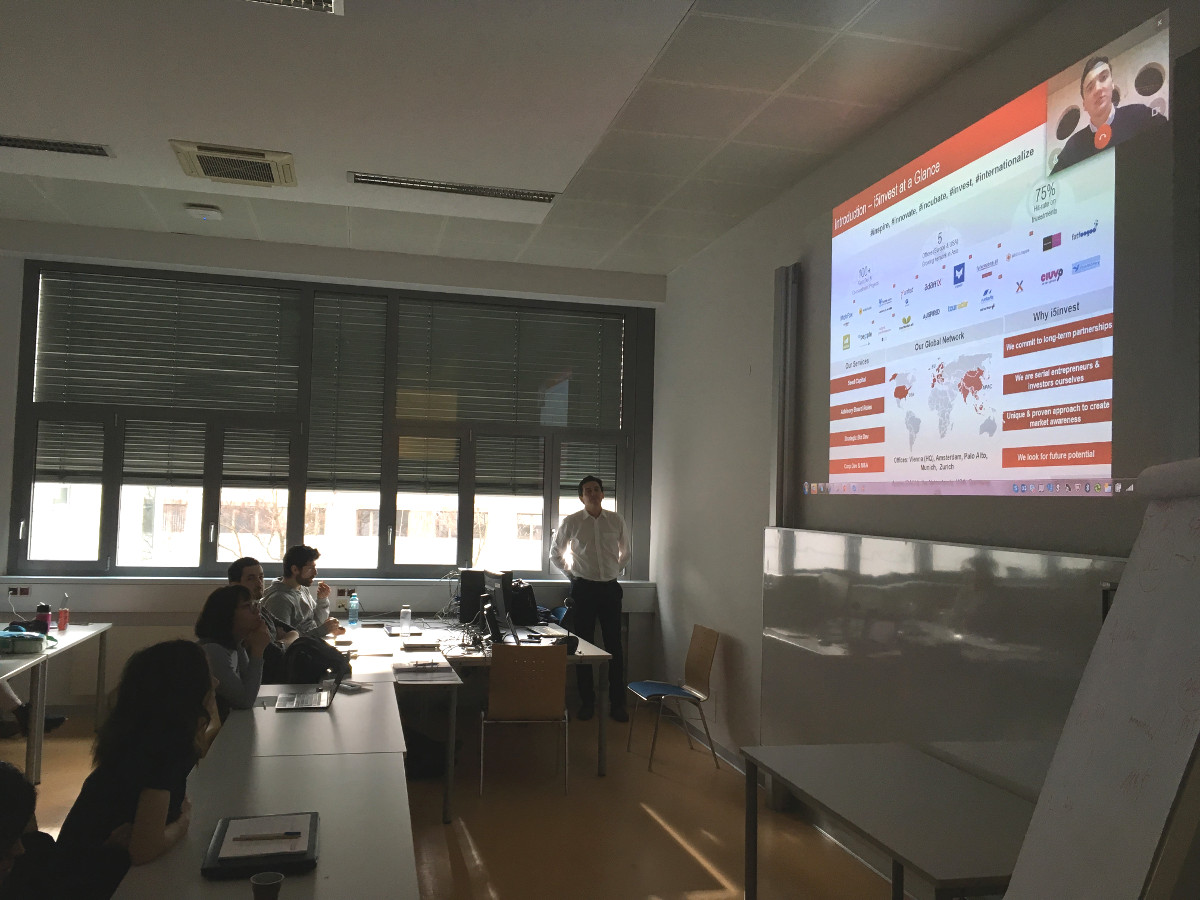

A guest lecture via Skype, held by Henry Morley from i5invest

Earlier this year, the students of the 3rd semester of our Business in Emerging Markets programme had a guest lecture held by Henry Morley, Senior Associate at i5invest, a Vienna-based company that supports national as well as international start-ups from scratch.

The guest lecture was part of the course “Mergers and Acquisitions in Emerging Markets” of Martin Gruber and had the aim to show students how i5invest structures and accompanies the M&A process of start-up companies. Henry Morley explained that his company is mainly focussing on young ventures with highly scalable and innovative business models as these are most interesting for business angels and venture capitalists worldwide according to Henry Morley.

Furthermore, Henry Morley introduced the students to different valuation methods that can be used for assessing the value of a start-up even at a very early stage of its existence and business operations. The discounted cash flow method was covered as well as the venture capital method, an asset-based valuation scheme and a scoring method.

At the end of this flawless and very interesting skype video conference, the students had the possibility to ask questions and to discuss the selection of start-up companies and other related topics with Henry Morley.

As an Austrian consulting company with offices in Amsterdam and Palo Alto, California, i5invest literally builds bridges and relationships across continents, market sectors and market players of different background, size and dynamics.

It was a great opportunity for our students not only to dive into this specific business but also a perfect addition to the course “Mergers and Acquisitions in Emerging Markets” which covers valuation methodologies but not to the detail Henry Morley explained when it comes to start-up companies.