The aim of the lab is to promote the innovative capacity of financial institutions such as banks, insurance companies and financial service providers, particularly those located in Styria. We achieve this by helping students and future employees in the region’s financial sector to acquire digital skills. The Digital Finance Lab is also a playground for start-ups, FinTechs and InsurTechs.

Digital Finance Lab

The Digital Finance Lab is used to investigate innovative technologies and their potential application in the financial, banking and insurance sector, to develop business models and processes and to create innovative products. This involves the use of blockchain, robotic process automation, artificial intelligence and other technologies, and state-of-the-art equipment including an infrared eye tracker and a Refinitiv / Thomson Reuters terminal for financial market data.

Robotic Process Automation

Fragmented finance systems and processes are the reason why many organisations are highly inefficient and forced to rely on manual processes and spreadsheet applications. This leads to additional costs, processing errors, wasted financial resources, greater internal control risks and the risk of generating inaccurate results. Robotic process automation (RPA) can be used to fully automate corporate processes across different software applications and media discontinuities by applying process analysis, digital maturity models and then implementing the consequent process optimisations.

Applications

- Analysis of applications in banks & insurance companies

- Bridging media discontinuities at interfaces to the core system

- Account closure, master data management, KYC, etc.

- Compliance, generation of regulation reports

- Securities processing

- Claims processing

- Claims settlement

Blockchain & Smart Contract Network

- Development of innovative business models based on blockchain technology

- Fully-automated insurance

- Decentralised processing for banking cooperation

- Tokenisation of assets (shares, bonds, real estate, etc.)

- Cryptocurrencies and ICOs

- Implementation via blockchain network for research & development with smart contracts

Financial Market Research & Application

The Digital Finance Lab is equipped with a Refinitiv / Thomson Reuters terminal for global intraday financial market data and a ByteWorx portfolio simulation application. These data and applications allow us to conduct state-of-the-art forecasting and empirical financial market research.

Applications

- Development of investment strategies

- Optimisation of risk management approaches

- Assessment of financial instruments

- Portfolio management

- Development of indices

- Financial market research

- Analysis of cryptoassets

Student projects

Using their own investment strategies, students at the Institute of Banking and Insurance Industry developed a real and tradable securities portfolio. The portfolio was then implemented as part of the Trading Desk project and published on the Wikifolio platform. Read more in the blog post

Artificial Intelligence & Machine Learning

Artificial intelligence and machine learning are becoming increasingly important in business, primarily due to the availability of huge volumes of data, rapid growth in computing power and capacity, and greatly improved machine learning approaches and algorithms. The technologies investigated in our Digital Finance Lab open up a wide range of applications in the financial, banking and insurance industry.

Applications

- Predictive data forecasting

- Customer behaviour & purchase probability

- Fraud protection

- Digital financial coach / advisor

- Credit risk assessment

- Valuation models

- Churn rate reduction

- Individual insurance solutions and ecosystem development

- Underwriting and risk assessment

- and much more

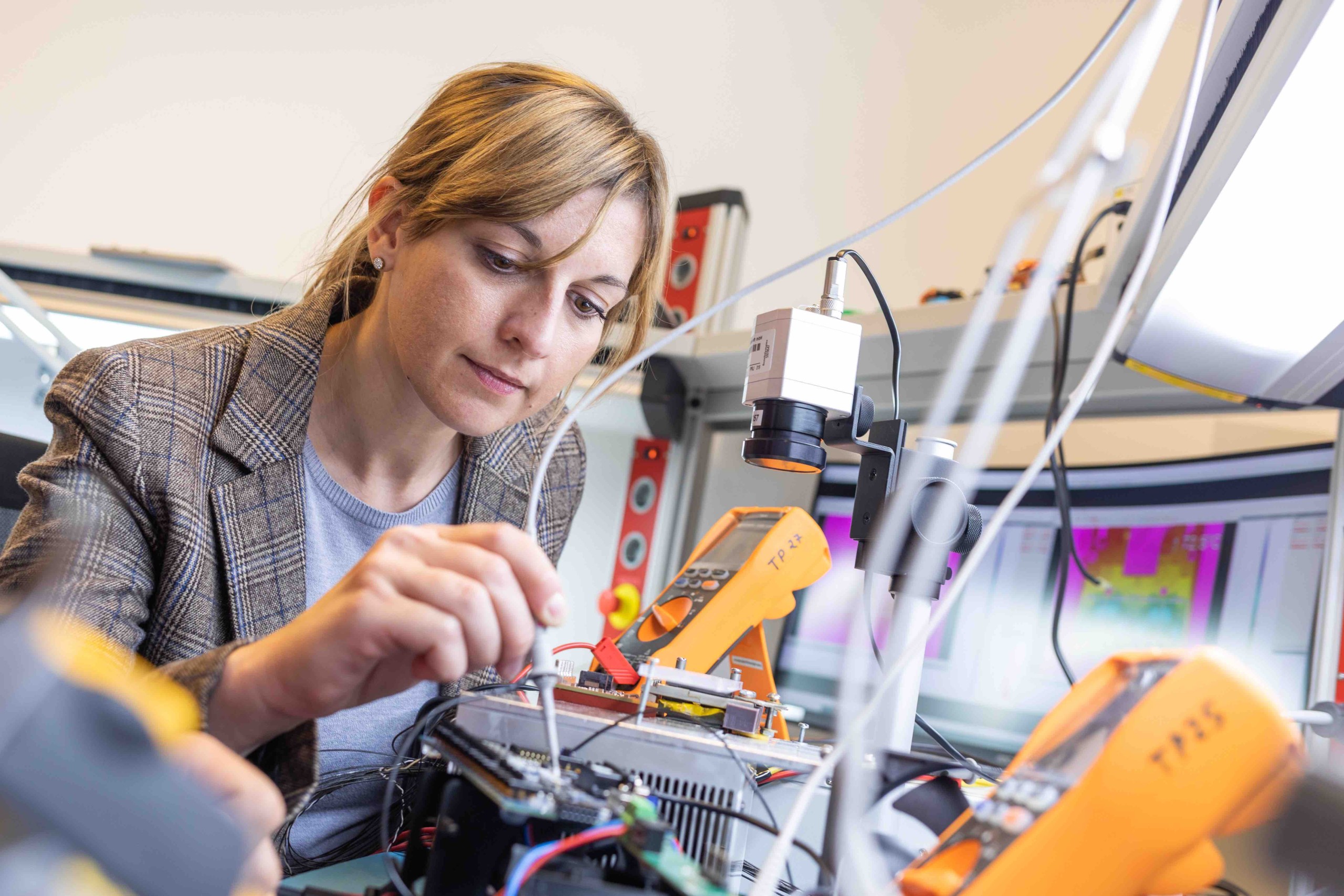

Eye Tracking

Eye tracking is a method applied to visualise a person’s eye movement. It is used to evaluate interactive and mobile applications and interactive products.

It is a valuable tool for measuring in which sequence, and for how long, users look at different areas of a user interface. This identifies which elements users look at attentively and which they completely ignore. In our eye tracking studies we first help you to define specific areas of investigation, before determining whether eye tracking can provide the answers.

Eye tracking is particularly valuable when used in combination with classic usability tests. We use our eye tracker to record a test participant’s eye movements while they work on a typical task such as ordering a product. Our objective eye tracking data supplement the subjective views provided by the test participants. Both the qualitative and quantitative results are then evaluated by our experts.

Our lab houses facilities for testing information designs using eye tracking, laboratory analysis and optimisation.

Applications

- Analysis of product documents

- Customer journey optimisation

- Analysis of customer communication, in particular risk communication and expectation management